Core Versus Headline Inflation Again

In a recent Economic Synopses essay, I questioned the Federal Open Market Committee's (FOMC's) emphasis on core inflation measures that strip away food and energy prices and provided some statistical analysis on the relative ability of core and headline inflation measures for predicting future headline inflation over the "medium term." (I defined the medium term as a horizon of two to three years.) I also concluded that, for the period since the mid-1980s, "there is no compelling evidence that core inflation is a better predictor of future headline inflation over the medium term." I then suggested that "in the interest of greater transparency and to allow the public to better understand its focus on core measures, the FOMC should provide evidence of the superior forecasting performance of the core measure it uses." My invitation was recently accepted by my colleagues at the Atlanta Fed in their

macroblog.

They analyze the predictive power of core and headline CPI inflation measures for the average CPI headline inflation rate over the next three years based on averages of core and headline inflation over the past 1, 3, 6, 12, 24, and 36 months and show that the core measures significantly dominate the headline measures in predictive accuracy at short horizons and that forecasts based on the 3-month core inflation measure is roughly as accurate in predicting CPI inflation over the next three years as the forecast using the most recent 3-year average of headline inflation.

They come to the following conclusions: "This observation suggests that paying attention to the core measure may allow you to spot changes in the inflation trend much more quickly than using headline alone" and that "the usefulness of a core inflation measure is best seen in the monthly and quarterly intervals that span FOMC meetings, not in the two- or three-year trends which are, by construction, largely silent about the most recent data." I am pleased my colleagues extended my analysis because it provides me with another opportunity to demonstrate why I believe that core measures are not useful for conducting monetary policy.

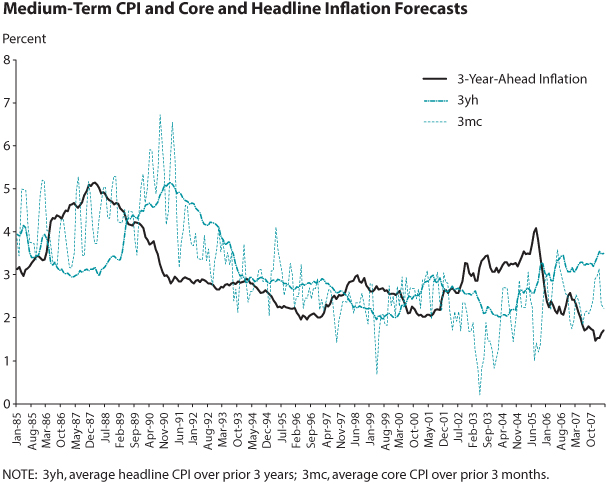

The chart shows medium-term (3-year average) CPI inflation since January 1985. It also shows the average level of core CPI inflation over the prior three months and the average level of headline CPI inflation over the prior three years—that is, the 3-month core (3mc) and 3-year headline (3yh) inflation forecasts. Three features of these data are relevant: First, it is pretty obvious that neither the 3mc nor the 3yh predicts medium-term CPI inflation very well. The root mean squared error (RMSE)—a measure of the average distance from the forecast to the actual series being forecast—is 1.06 percent and 1.04 percent for the 3mc and 3yh measures, respectively. This means that it is fairly likely that forecasts of inflation over the next three years could be off by a full percentage point or more. Given that the FOMC's inflation target appears to be about 2 percent, such errors are very large relative to that target.1 Indeed, I believe that forecasts that generate average errors this large are of little use to policymakers.

Second, most of the advantage of the 3mc measure over the 3yh measure occurs early in the sample period, when there is a large persistent swing in medium-term inflation. Since the early 1990s there have been no such swings in inflation and the 3yh measure performs somewhat better than the 3mc measure; the RMSEs since January 1994 are 0.98 percent and 0.79 percent for 3mc and 3yh, respectively. Hence, neither measure is a consistently better predictor of medium-term inflation.

The third thing to notice is that the 3mc forecasts are very volatile. For example, the 3mc measure was just 0.20 percent in May 2003, suggesting that inflation would be essentially zero over the next three years. However, just three months later the 3mc measure was suggesting that inflation would be nearly 10 times higher. Indeed, the behavior of core inflation in early 2003 led the FOMC to express concern about deflation that proved to be unwarranted.2 Of course, this is not too surprising because a forecast based on just three months of data does not average out the "noise" in monthly data. It does suggest, however, that 3mc may not allow policymakers to "spot changes in the inflation trend much more quickly."

There is essentially no difference between the best core predictor and the best headline predictor. But let me reemphasize my essential point: Neither core nor headline inflation measures can consistently and reliably predict medium-term inflation well enough to be of much use to policymakers.3 Given that (i) neither can predict medium-term inflation very well, (ii) differences between the core and headline inflation measures have been relatively large and very persistent, and (iii) consumers are at least as concerned about food and energy prices as they are about other prices that compose the index, it is difficult to rationalize the FOMC's preoccupation with core measures. The preoccupation with core measures would makes sense only if core measures consistently and accurately forecast medium-term inflation. It appears that no measure does this consistently and accurately.4

I believe that policymakers should pick an index that they believe best reflects inflation. (I believe that the CPI is sufficient for that purpose; moreover it is a widely used index for public and private contracts, etc.) And monetary policy should be conducted based on the behavior of this index. Specifically, when this inflation measure moves persistently above or below the policymaker's inflation objective, they should tighten or ease policy, respectively. As I noted in my previous Economic Synopses essay, the FOMC's preoccupation with core inflation may have resulted in a higher average rate of inflation: Core CPI inflation averaged 2.02 percent over the past decade, while headline inflation averaged 2.67 percent—a difference that nears a full percentage point above what appears to be the FOMC's inflation objective.

Notes

1 See the transcript of Chairman Bernanke's first press conference at www.federalreserve.gov/monetarypolicy/fomcpresconf20110427.htm.

2 For a discussion of the FOMC's concerns and their effect, see Thornton, Daniel L., "The Lower and Upper Bounds of the Federal Open Market Committee's Long-Run Inflation Objective," Federal Reserve Bank of St. Louis Review, May/June 2007, 89(3), pp. 183-93.

3 To get some insight into how small the RMSE would have to be to be useful for policy purposes, assume that that forecasts are unbiased, so the RMSE represents the standard deviation of the forecast error. Further assume that the forecast errors are normally distributed. Now assume that the FOMC has a medium-term inflation objective of 2 percent and that policymakers will consider their efforts successful if during the medium-term period the average inflation rate does not deviate from the target by more than half a percentage point. Assuming that policymakers respond appropriately and that policy actions are effective over the medium-term horizon, the RMSE would have to be no larger than 0.25 percent for policymakers to achieve their policy objective with a high degree of certainty. If policymakers wanted to be very certain of achieving their objective, the acceptable RMSE error would have to be much smaller. It would also have to be smaller if the acceptable error was less than half a percentage point, policy actions were less effective, or policymakers did not respond appropriately.

4 Jon Faust and Jonathan H. Wright ("Forecasting Inflation," unpublished manuscript, May 23, 2011) find that very few of the wide variety of inflation forecasting models that they consider generate out-of-sample RMSEs much below 1.0 percent—and none below 0.70 percent.

© 2011, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed